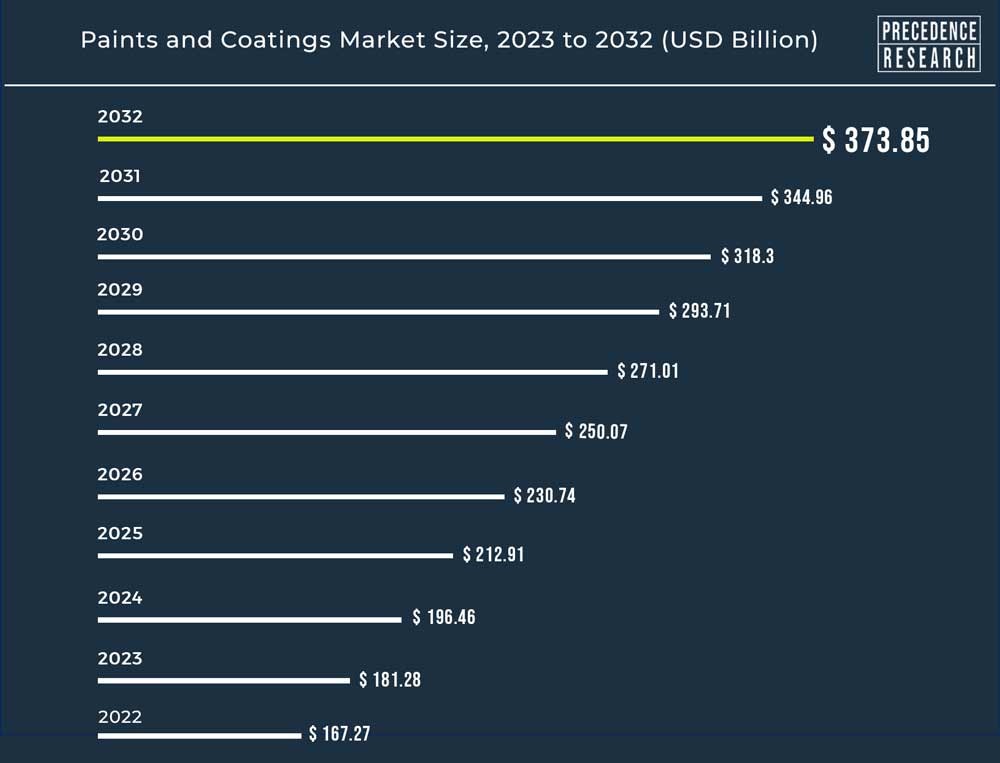

Tokyo, Feb. 07, 2023 (GLOBE NEWSWIRE) -- The paints and coatings market size will reach at USD 181.28 billion in 2023. Coatings are largely used to improve surface qualities and stop substrate deterioration, as opposed to paints, which are colored liquids meant to enhance the substrate's aesthetics. Coatings that are waterborne, powdered, high solids, radiation-cured, and solvent-borne are a few examples of often-seen product varieties. It is frequently used to decorate buildings, infrastructure, and industrial equipment, both residential and non-residential. Anti-fouling, flame-retardant, and anti-microbial qualities are all present in paints and coatings.

Additionally, they shield the surface from damaging environmental factors like corrosion, weathering, and chemical exposure. They thus have a wide range of uses in the transportation, automotive, building, and marine industries. For instance, a report released by the National Investment Promotion and Facilitation Agency estimates that in 2021, infrastructure projects accounted for 13% of all FDI inflows. As a result, the expanding architecture and construction sector is anticipated to see an increase in demand for paints and coatings.

Furthermore, the automotive industry has seen significant growth in the use of paints and coatings for corrosion protection applications in under-the-hood parts, engine components, interiors of containers, and storage vessels due to factors like increased disposable income, technological advancements, and the growth of original equipment manufacturers (OEMs).

Key Takeaway

· By product, the waterborne segment has generated revenue share of 39.4% in 2022.

· By material, the acrylic segment has held revenue share of 45% in 2022.

· The polyurethane segment is poised to reach at a CAGR of 5.8% between 2022 to 2030.

· By application, the architectural and decorative segment revenue share was 59.6% in 2022.

· Asia Pacific region has accounted 39.7% revenue share in 2022.

Market Growth

Growing product consumption in the construction, automotive, and general industry application sectors is anticipated to drive the market. The demand for products across a range of applications is expected to be fueled by the rapid urbanization and industrialization occurring in emerging nations like India, China, and Southeast Asia. Granules, free powder, or particles from the integration process are subsequently put into the finished product matrix. Some of the most recent inventions made possible by nanotechnology include goods with electrical conductivity, UV protection, and self-healing capabilities. Aside from these, they are also very scratch, mar wear, and corrosion resistant. Consequently, these technological developments and the launch of new products are anticipated to increase over the projection period, the industry is expected to grow.

Regional Analysis

In 2022, the market was dominated by Asia Pacific, which includes China and Southeast Asia. Over the course of the forecast period, rising construction activities and escalating automobile industry demand in developing nations like China, India, Japan, and Southeast Asia are anticipated to propel the market.

Additionally, there is numerous potentials for market expansion due to the simple availability of raw materials and less onerous VOC emission regulations than those in North America and Europe. In 2022, the paints and coatings market were dominated by Europe. Since the UK has been one of the major markets for paint and coatings, the paints and coatings industry is likely to be impacted given how dynamic the European market has been since Brexit.

Demand for the product is anticipated to be driven by rising auto production in Hungary, Germany, Austria, Romania, and the UK, as well as by the robust manufacturing operations of businesses like Volkswagen AG, Daimler-Chrysler, Chevrolet, Dodge, and Mercedes-Benz.

Technology Overview

The manufacturing process for paints and coatings is initiated by using raw materials such as pigments, solvents, and resins. Paints and coatings are manufactured by mixing a certain ratio of resin binders with solvents using a mechanical agitator in a mixing tank. After mixing, the batch is passed through a filter and the final product is packed for sale. In the case of colored paints and coatings, the manufacturing process remains the same except that the pigments are first dispersed in a portion of polymer/carrier.

SOLVENT-BASED

Solvent-based coating is a conventional technology used for manufacturing paints and coatings.

Lacquer thinner, aliphatic hydrocarbons, xylene, and toluene are some of the commonly used solvents in the manufacturing process. However, the global solvent market, in terms of paints and coatings, has undergone a paradigm shift owing to the adverse effects of volatile organic compounds present in crude oil-based solvents on the environment.

There are two variants of solvents namely conventional solvents and organic solvents. Conventional solvents consist of glycol ethers, hydrocarbons, acetate esters, alcohols, chlorinated and ketones. Organic solvents are majorly used in traditional applications such as dry cleaning and also in manufacturing industries. Organic solvents are highly flammable in nature except chlorinated solvents.

WATER-BASED

Water, as a solvent, is used in a coating for the external environment to improve thermal protection, wear resistance, and corrosion/glazing of the paints and coatings. Paints and coatings use water as a solvent medium that can be water-borne or solvent-borne depending on the formulation requirements. Water-based paints and coatings offer certain advantages over solvent-based products, which include low volatile organic compound (VOC) emissions, ease of application, and quicker drying time. Water-based products can be made using various resins such as styrene-butadiene, acrylic, and polyurethane.

POWDER COATING

Powder coatings come in two resin types, namely thermoplastics and thermosetting plastic polymers. Thermosetting plastic polymers is expected to account for a significant market share over the forecast period as they are comparatively more heat stable than thermoplastics. This is a modern advantage over the traditional solvent/water-based technology. The use of powder-based technology reduces/eliminates the issues related to liquid technologies. Following are the advantages of powder-based coatings over liquid coatings:

· Performance – Powder coatings exhibit better resistance to chemicals, corrosion, weather, chipping, and scratching compared to wet paints. Powder coatings are better in terms of color as they stay bright and fresh for a long period.

· Operational costs – Powder coatings are more economical and cover more surface area compared to any other organic solvent. These coatings reduce the cost in terms of operational labor as the operators require less training and guidance. Powder-based paint technology offers minimized waste production, reduced energy costs, and lower disposal costs

Lencolo is proud to be an industry leader and growing entity in China. Our catalog currently consists of various energy curing raw materials, including UV curing oligomers (UV resins), monomers, additives, photoinitiators and other functional specialty chemicals. If you have any inquiry, welcome to contact us anytime!

2022-08-03

2025-01-06